Before knowing How Does PayPal Work here you can go through some interesting facts. PayPal, a very well known name for all because of its ultimate payment solution and it works across the currencies and countries. PayPal is currently holding more than 100 million active accounts with 25 currencies. The company was founded in 1998 and it made its first electronic transaction possible in 1999, and in 2000 the company was acquired by X.com Corporation. The corporation renamed as PayPal in 2001.

PayPal’s headquarters are located in San Jose, California, and the USA but the company also has its operations in Germany, Ireland, China, Israel, and India. PayPal is one of the great success stories of the web and an example of first mover advantage. How does PayPal Work, is the interesting topic to know when we are talking about PayPal. So, let’s start to know about PayPal and its Business Model.

How does PayPal Work?

Now, let’s see how does PayPal work for those who need it. PayPal, which started as an online payments solution, has now transformed itself into a powerful finance tool that allows the user to –

Transfer Cash to and from a Bank Balance or PayPal Account – The user can transfer cash to 202 nations and in around 100 monetary forms through PayPal. Similar cash can be kept to financial balances in 56 monetary forms or can be held as adjust in PayPal account in 25 monetary forms.

Checkout at Sites with Only a Single Click – PayPal has propelled its new innovation ‘One Touch’ which spares his/her PayPal login points of interest safely in his/her gadget and gives a user a chance to look at on a site without composing his/her PayPal username and password.

Get a PayPal Debit Card – PayPal’s debit card works simply like some other bank’s debit card. The user can utilize his/her PayPal debit card to shop on the online and offline, pull back cash, and procure remunerates on his/her buys. PayPal check card is connected to his/her PayPal account.

Spare and Access His/her Debit and Visa Card through PayPal Client ID and Password – PayPal is a computerized wallet which spares the subtle elements of his/her charge and Mastercards and let the user shop and transfer cash online by simply recalling his/her PayPal client id and password.

Get Working Capital Loan – this is stand-out day by day payable loan helps the user to satisfy everyday business task needs at a less expense.

Appreciate Advantages of PayPal Credit (No Intrigue Acknowledge) – Originally named as Bill Me Later, PayPal credit is an element which gives a user a chance to get a no intrigue credit of $99 or progressively if the sum is ponied up all required funds in a half year.

Get Payments through PayPal (Payment Entryway) – User can offer products on the web and offline and get cash through PayPal. All users require a PayPal business account. PayPal at first picked up prominence when it was incorporated as an instalment entryway at eBay.

Get PayPal Business in Crate Business Arrangements – User can set up his/her business online with PayPal business in a case apparatuses.

PayPal Business Model

PayPal is there to replace the paper payment solutions like cheque and cash. It has revolved through the large cycle until it figured out the current cycle. PayPal Business Model is somewhat similar to the Payment Gateway Business Model. The difference is that PayPal allows payments in multiple currencies across the world. That is where PayPal attracts users across the globe. Moreover, PayPal has acquired Venmo which makes it possible to be used by local stores.

Mechanism of PayPal Business Model is similar to other payment aggregators. Any transaction which successfully passes through is subject to a TDR (Transaction Discounting Rate) which is the fee for processing the payment transaction.

So, After going through How does PayPal Work and PayPal Business Model. Now it turns to move towards the PayPal Scams. If you see then you come to know that PayPal Business Model is too much depended on arbitrage. So, a Blockchain Business Model like Bitcoin Business Model can be the difficulties for the PayPal Business Model to survive and to get money.

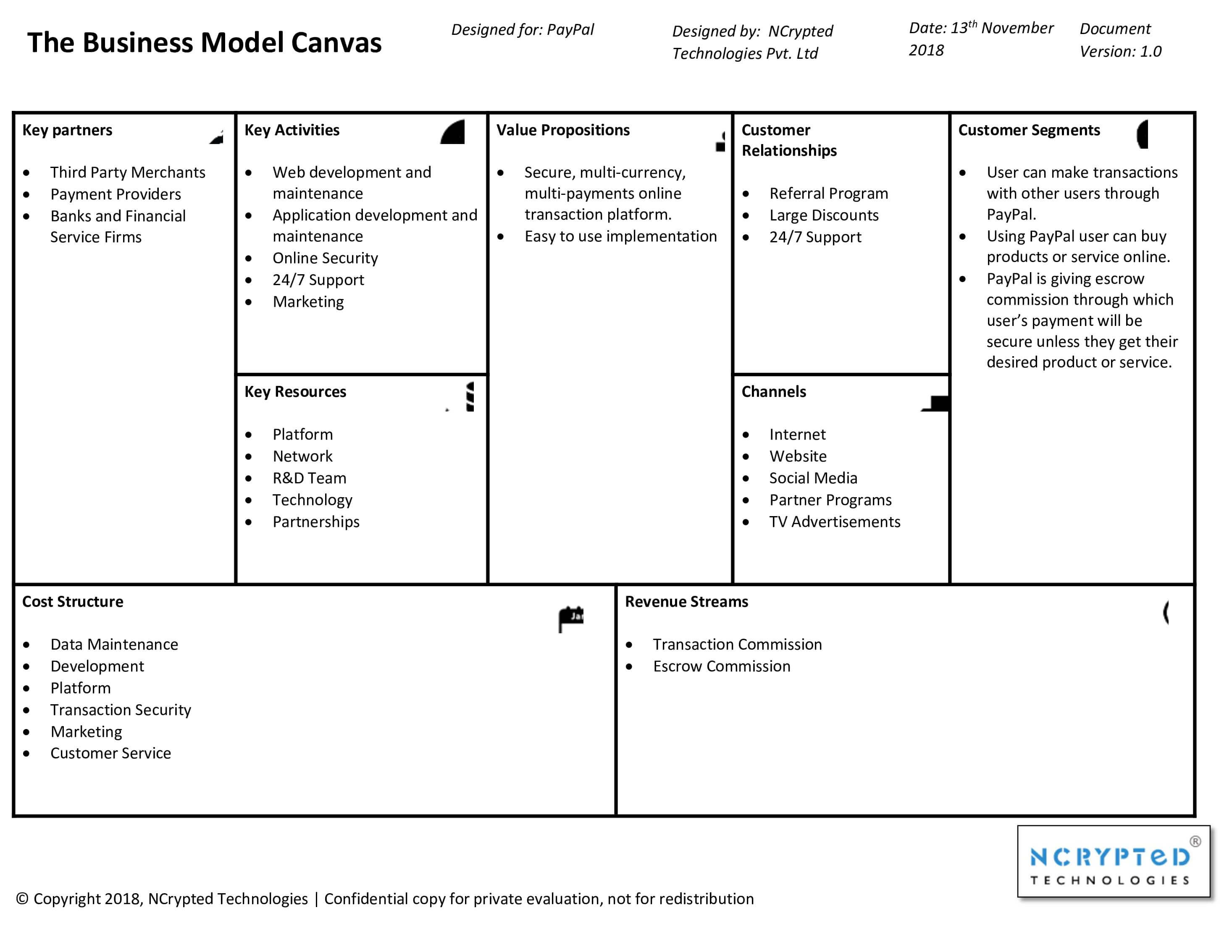

PayPal Business Model Canvas

PayPal Scams and How to Avoid Them

Below are the types of Paypal scam which would give you detailed information on safety measure while using payment gateways like PayPal.

Advance Fee PayPal Scam

People get an offer for free money, there is probably a catch. Fraudsters will promise the user to transfer millions to his/her account but before that, fraudsters will ask for some advance payment for legal document, tax or for some other reasons. But after spending by users for these, they never get the millions which were promised by fraudsters.

How to avoid advance fee scam: Don’t wire money to someone you don’t know.

Overpayment PayPal Scam

A customer sends a PayPal payment that is more than the purchase price of the order and then asks a seller to wire them the difference. A client sends a PayPal payment that is more than the price tag of the request, and after that requests that seller wire them the distinction.

They may disclose to the seller that they inadvertently overpaid to the seller, the additional cash is for the delivery costs, they’re giving the seller a reward for his/her incredible service or the cash is for the pressure they’ve caused him/her. They may even request the seller to wire the delivery expenses to their shipper.

How to avoid overpayment scam: People should not wire money to someone to whom they don’t know. A legitimate buyer never overpays for any order. And the other thing is people should not wire money to the bogus shipping company.

Shipping Address PayPal Scam

The scammer asks to ship the order to some specific address and when a seller sends an item that address, shipping company would not be available to find that address as that delivery address is invalid. And when the shipping company call the scammer for address, he/she will give the right address and will get the product and after that, he/she will file the complaint to PayPal the item is not delivered although he/she got the item.

How to avoid shipping address scam: If a customer asks to use their shipping service, review their order for fraud carefully. They may have used a stolen card or bank account to fund the purchase.

Ship to the address on the Transaction Details page.

Hacked PayPal Scam

PayPal sends an email to the seller saying that money has been deposited to his/her account and then seller login to the account and money would be there so seller ship the order. After some day, another email from PayPal is being sent to the seller that the money has been withdrawn from the account due to fraud. The actual thing which happened is, hackers hack someone’s account to make payment but when PayPal caught this thing, they reimburse the money under certain conditions.

How to avoid hacked PayPal scam: The payment must be marked as “eligible” on Transaction Details page. The seller must provide proof of delivery or proof of shipment.

Share Your Thoughts with Us!

What is your opinion regarding the article How does PayPal Work and PayPal Business Model? Tell us in the comment section below.

Here are some informative articles crafted by NCrypted Websites, it’d help further to understand how do online businesses work with their business models.

PayPal scams are seemingly not disappearing anytime soon, so it’s better to avoid them as you described.

PayPal has an inherently different business model than traditional online business.