In today’s fast-paced world, financial flexibility and efficiency are paramount. Revolut emerges as a groundbreaking platform, transforming how people manage their money, make transactions, and navigate the complexities of global currencies, all from the convenience of their mobile devices. With millions of users globally, Revolut has become the go-to solution for those seeking a seamless, cost-effective way to handle their finances. Understanding Revolut goes beyond just user engagement; it’s about revolutionizing financial management, saving money, and enhancing daily life. Find out in this article how does Revolut make money.

Revolut has developed a diverse revenue model through subscription plans, currency exchange fees, and strategic partnerships with financial institutions. This approach highlights its financial operations, growth potential, and impact on the fintech sector.

Find out more about Revolut through our team’s articles on what is Revolut.

Revolut Business Model

Revenue Streams

Subscription Fees

- Premium Accounts: Revolut offers different tiers of premium accounts (Plus, Premium, and Metal) with additional features such as higher limits on free currency exchanges, travel insurance, and priority customer support. Users pay a monthly or annual subscription fee for these accounts.

Read more Disclosing the Facts of Subscription Business Model

Interchange Fees

- Card Transactions: Revolut earns interchange fees from merchants whenever users make purchases using their Revolut cards. These fees are a percentage of the transaction amount.

Currency Exchange Fees

- Forex Transactions: While Revolut is offering free currency exchanges up to a certain limit, it charges a fee for exchanges beyond this limit and for exchanges made during weekends.

Cryptocurrency Trading Fees

- Crypto Transactions: Revolut charges a fee on transactions involving buying, selling, and trading cryptocurrencies.

Find out more about cryptocurrencies in our article How does Cryptocurrency work

Interest on Deposits

- User Deposits: Interest earned on user deposits held in partner bank accounts.

Insurance Products

- Travel, Device, and Health Insurance: Revenue from selling insurance products to users, often bundled with premium accounts.

Commission from Stock Trading

- Stock Transactions: Fees earned from users trading stocks through the Revolut app.

Strategic Partnerships

Revolut has formed strategic partnerships to enhance its service offerings and expand its capabilities

Banking Partners

- Licensing and Support: Partnerships with traditional banks provide necessary banking licenses and support for Revolut’s operations.

Payment Processors

- Transaction Facilitation: Collaborations with payment processors like Visa and Mastercard facilitate smooth transaction processing for Revolut card users.

You may like to read; How does Square work?

Insurance Providers

- Insurance Products: Partnerships with insurance companies enable Revolut to offer travel, healthcare, and device insurance to its users.

If you are interested in building a healthcare app kindly go through our article Healthcare App Development Guide

Technology Providers

- Infrastructure and Security: Partnerships with tech companies ensure robust infrastructure and advanced cybersecurity measures.

Customer Experience

User-Friendly App

- Intuitive Interface: The Revolut app is designed to be user-friendly and intuitive, making it easy for users to manage their finances.

Comprehensive Services

- All-in-One Platform: Revolut also provides a wide range of services including banking, currency exchange, budgeting tools, and investment options, all within a single app.

Customer Support

- 24/7 Support: Revolut provides round-the-clock customer support through in-app chat and email to assist users with their queries and issues.

Personalized Features

- Tailored Services: Personalized financial services and products based on user behavior and preferences.

Expansion and Growth

Geographical Expansion

- New Markets: Revolut has been expanding into new geographical marketplaces, including North America, Asia, and Australia, to reach a broader audience.

User Base Growth

- Customer Acquisition: Aggressive marketing and promotional campaigns to attract new users and grow its customer base.

Product Diversification

- New Services: Continuously adding new services such as cryptocurrency trading, stock trading, and insurance products to attract different segments of users.

Innovation and Growth

Technological Advancements

- Continuous Development: Regular updates and improvements to the app’s features and functionalities to keep up with technological advancements and user needs.

AI and Data Analytics

- Smart Features: Leveraging AI and data analytics to offer personalized financial insights and recommendations to users.

Open Banking

- Integration: Embracing open banking to allow seamless integration with other financial services and platforms.

Sustainability Initiatives

- Green Banking: Introducing eco-friendly banking solutions and sustainability initiatives to attract environmentally conscious users.

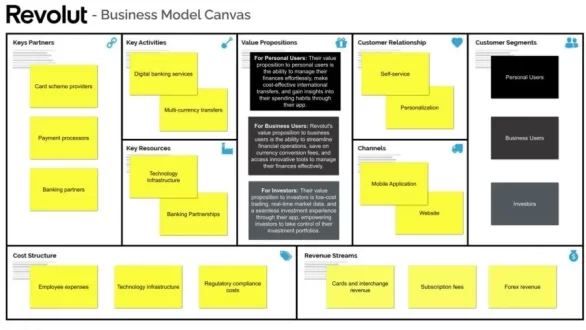

Revolut Business Model Canvas

1. Customer Segments

- Individual Users: Primarily millennials and tech-savvy individuals looking for a digital-first banking experience.

- Frequent Travelers: People who travel often and require cost-effective multi-currency solutions.

- Freelancers and Gig Workers: Those who need easy ways to manage international payments and receive funds in different currencies.

- Small and Medium Enterprises (SMEs): Businesses that need comprehensive financial management tools, including expense tracking, multi-currency accounts, and corporate cards.

2. Value Propositions

- Multi-Currency Accounts: Hold and exchange multiple currencies at interbank rates.

- Fee-Free International Transfers: Cost-effective international money transfers.

- Comprehensive Financial Services: Includes budgeting tools, cryptocurrency trading, stock trading, and insurance products.

- Convenient Mobile Banking: All services are accessible through a user-friendly mobile app.

- Security and Transparency: Advanced security features and clear, upfront fees.

3. Channels

- Mobile Application: Primary platform for user interaction and transactions.

- Website: Information portal and account management.

- Customer Support: In-app chat, email support, and customer service teams.

- Partnerships: Integration with other fintech services and financial institutions.

4. Customer Relationships

- Self-Service: User-friendly app for independent account management.

- Customer Support: In-app and email support for troubleshooting and assistance.

- Community Engagement: Active community forums and social media presence to engage users and gather feedback.

- Personalized Services: Tailored financial products and premium accounts with additional features.

5. Revenue Streams

- Subscription Fees: Premium accounts (Plus, Premium, and Metal) offer enhanced features for a monthly or annual fee.

- Interchange Fees: Small fees are taken from merchants every time a user makes a card payment.

- Currency Exchange Fees: Fees for currency exchanges beyond free monthly limits.

- Cryptocurrency Trading Fees: Fees charged on buying and selling cryptocurrencies.

- Interest on Deposits: Earning interest on user deposits in partner bank accounts.

- Insurance Products: Revenue from selling travel, device, and health insurance.

6. Key Resources

- Technology Platform: The Revolut app and backend infrastructure.

- Financial Licenses: Necessary licenses to operate as a financial institution in various regions.

- Partnerships: Collaborations with banks, payment processors, and fintech companies.

- Human Resources: Skilled workforce including developers, customer support, and compliance teams.

- Brand: Strong brand presence and customer trust.

7. Key Activities

- Platform Development: Continuous improvement of the app and addition of new features.

- Customer Acquisition: Marketing and promotional activities to attract new users.

- Regulatory Compliance: Ensuring adherence to financial regulations across different regions.

- Customer Support: Providing timely and effective support to users.

- Partnership Management: Managing relationships with financial institutions and other partners.

8. Key Partnerships

- Banks and Financial Institutions: For banking licenses and operational support.

- Payment Processors: Facilitating transactions and card payments.

- Regulatory Bodies: Ensuring compliance with financial regulations.

- Technology Providers: Supporting infrastructure and cybersecurity.

9. Cost Structure

- Technology Development: Costs associated with app development and maintenance.

- Customer Support: Operating customer service centers and support systems.

- Marketing and Sales: Advertising, promotions, and user acquisition costs.

- Compliance and Legal: Ensuring compliance with global financial regulations.

- Operational Costs: Daily operations, employee salaries, and office expenses.

Revolut Alternatives

Learn additional details about Alternatives to Revolut in an article by our team on Revolut Alternatives

When exploring alternatives to Revolut, several noteworthy options cater to diverse financial needs. Monzo, a popular choice, offers a user-friendly app with features like budgeting tools and instant notifications. Another strong alternative is N26, known for its streamlined interface and robust international banking capabilities. For those seeking a comprehensive digital banking experience, Chime provides a range of features, including no-fee banking and automatic savings. Each of these alternatives brings unique benefits, allowing users to select the platform that best fits their financial requirements and preferences

Explore more about Monzo in an article by our team How does Monzo work?

How Does Revolut Make Money?

Revolut primarily earns through premium and metal accounts, merchant commissions on card transactions, and fees for account top-ups and expedited transfers. Additional revenue comes from charges for excessive ATM withdrawals and transactions beyond set limits. The online bank has experienced significant growth, partly fueled by crowdfunding and support from global investors. It operates centers in London, Moscow, and St. Petersburg, with plans to expand into North America, Asia, and the Middle East.

You may also like to read How does Crowdfunding work

Detailed insight into how Revolut makes money

- Subscription Fees: Revolut offers premium subscription plans like Revolut Premium and Revolut Metal, which provide users with enhanced features such as higher withdrawal limits, travel insurance, and cryptocurrency cashback. Users pay a monthly or annual subscription fee for these premium accounts.

- Transaction Fees: Revolut earns revenue from transaction fees, particularly from card transactions. This includes interchange fees paid by merchants when users make purchases using their Revolut cards. Additionally, Revolut charges fees for currency exchange transactions, especially for exchanges exceeding specified limits or conducted during weekends when markets are closed.

- Cryptocurrency Services: Revolut facilitates cryptocurrency trading within its app, charging fees on transactions involving buying, selling, and exchanging cryptocurrencies. These fees contribute to its revenue.

- Overdraft Fees: Revolut provides overdraft facilities to eligible users, charging fees based on the overdraft amount and duration of usage.

- Interest on Deposits: Revolut earns interest on user deposits held in partner banks. Although primarily a digital bank, Revolut collaborates with traditional banks to hold and manage user funds, earning interest on these deposits.

- Commissions from Investments: Revolut allows users to invest in stocks and commodities through its platform, earning commissions on these investment transactions.

- Insurance Sales: Revolut provides various insurance products, including travel insurance and device insurance, to its users. Revenue is generated from selling these insurance policies.

- Business Services: Revolut provides business accounts with additional features tailored for businesses, charging fees for services such as corporate cards, expense management tools, and international transfers.

- Partnerships and Affiliations: Revolut partners with other financial institutions, payment processors, and service providers. These partnerships may involve revenue-sharing agreements or referral fees for new customer acquisitions.

- Premium Features and Add-ons: Beyond basic banking services, Revolut also offers premium features such as disposable virtual cards, priority customer support, and concierge services for premium account holders, charging additional fees for these add-ons.

Revolut Bank

Revolut Bank is a digital banking arm of Revolut, offering financial services such as savings accounts, loans, and overdraft facilities through its app. It combines traditional banking features with modern fintech innovations, providing users with a seamless and integrated banking experience.

Funding Rounds: Revolut

Seed Round (2015)

Revolut raised approximately $1.7 million in its seed funding round. This initial investment helped kickstart its operations and product development.

Series A (2016)

In July 2016, Revolut secured $10 million in its Series A funding round led by Balderton Capital, with participation from Seedcamp and other investors. This funding was used to expand its team and accelerate growth.

Series B (2017)

In April 2017, Revolut raised $66 million in its Series B funding round led by Index Ventures and Balderton Capital. This funding round enabled Revolut to launch new features, expand its user base, and strengthen its market position.

Series C (2018)

In April 2018, Revolut raised $250 million in its Series C funding round led by DST Global, with participation from Index Ventures and Ribbit Capital. This funding round valued Revolut at over $1.7 billion and supported its global expansion efforts.

Series D (2019)

Revolut raised $500 million in its Series D funding round in February 2019, led by TCV with participation from DST Global and other investors. This funding round valued Revolut at $5.5 billion and supported its expansion into new markets and the introduction of additional financial services.

Series E (2020)

In July 2020, Revolut raised $580 million in its Series E funding round led by TCV and Tiger Global Management, with participation from other investors. This funding round further bolstered Revolut’s valuation and supported its continued product innovation and geographic expansion.

TL; DR- How Does Revolut Make Money?

Revolut’s diverse revenue streams showcase a robust and innovative business model that leverages subscription plans, transaction fees, cryptocurrency services, and partnerships to generate income. With a focus on user-centric financial solutions and strategic expansions into new markets, Revolut continues to evolve and drive revenue growth. By embracing digital banking innovations and offering tailored financial products, Revolut remains at the forefront of fintech, ensuring sustainable profitability and customer satisfaction in the competitive financial services industry.

Revolut makes money primarily through subscription plans (Standard, Premium, Metal), transaction fees (e.g., currency exchange, ATM withdrawals), interchange fees from card transactions, cryptocurrency trading fees, and partnerships with other financial services providers. Additionally, revenue comes from premium services, business accounts, interest on deposits, advertising, and data analytics sold to third parties.

Want to Launch Your Own Business Similar to Fintech?

If you want to start your own fintech platform – you should go with Fintech Script which has customized features to let you roll with your own fintech platform business.