Fintech, short for financial technology, refers to the innovative use of technology to provide financial services and solutions. This rapidly evolving sector encompasses a wide range of applications, from mobile banking and digital payments to blockchain and investment apps. Fintech aims to streamline, enhance, and democratize financial services, making them more accessible, efficient, and user-friendly. As the fintech industry continues to grow, it is reshaping the financial landscape, driving increased competition, and fostering greater financial inclusion worldwide.

In this article, we will delve into alternatives to Revolut and explore apps similar to Revolut.

Want to know more about what is Revolut? Read our article.

Revolut is a digital banking and financial technology company that provides a wide array of financial services through its mobile app. Founded in 2015 in the United Kingdom by Nikolay Storonsky and Vlad Yatsenko, Revolut initially offered a prepaid debit card for fee-free currency exchange. Since then, it has expanded its services to include personal and business accounts, cryptocurrency trading, budgeting tools, savings vaults, and international money transfers.

Revolut Business

It is a comprehensive financial platform designed for businesses of all sizes, offering a suite of tools and services to manage finances efficiently. Here’s a detailed overview:

Key Features

Multi-Currency Accounts:

- Hold, receive, and exchange money in over 30 currencies.

- Use local accounts for different currencies to avoid international transfer fees.

International Payments:

- Send and receive international payments at competitive exchange rates.

- Free international and local payments are included in the same plan.

Corporate Cards:

- Issue physical and virtual cards to employees.

- Control spending with custom limits and track expenses in real-time.

Expense Management:

- Simplify expense reporting with integrated tools.

- Capture receipts and categorize expenses on the go.

Payment Gateway:

- Accept payments online through secure gateways.

- Integration with major e-commerce platforms.

Integrations:

- Seamless integration with accounting software like Xero and QuickBooks.

- API access for custom integrations with business tools.

Perks and Discounts:

- Access to exclusive offers and discounts from Revolut’s partners.

- Benefits include discounts on software, services, and travel.

Security and Control:

- Multi-layered security protocols, including two-factor authentication.

- Instant notifications and the ability to freeze/unfreeze cards.

Plans and Pricing

It offers multiple plans to cater to different business needs, from startups to large enterprises.

| Plan | Monthly Fee | Features |

|---|---|---|

| Free | £0 | Basic account with limited features and transactions. |

| Grow | £25 | More transactions, multi-currency accounts, expense management, and priority support. |

| Scale | £100 | Higher transaction limits, advanced integrations, and additional user accounts. |

| Enterprise | Custom | Tailored solutions with dedicated account management and custom integrations. |

Benefits

- Cost Efficiency: Save on international transfers and currency exchange fees.

- Flexibility: Manage finances from anywhere with a robust mobile app.

- Transparency: Real-time tracking of transactions and expenses.

- Global Reach: Operate seamlessly across borders with multi-currency accounts.

How to Set Up Revolut Business Account

- Sign Up: Visit the Revolut website and sign up for an account.

- Choose a Plan: Select the plan that best suits your business needs.

- Verification: Complete the verification process by providing the necessary documents.

- Set Up: Configure your account, issue cards, and integrate with your business tools.

Importance of exploring Revolut alternatives

Diverse Financial Needs

Individuals and businesses have unique financial needs that a single platform may not fully address. Exploring alternatives ensures that you find a service that best matches your specific requirements, whether it’s lower fees, more robust business tools, or better customer support.

Cost Efficiency

Different financial platforms offer varying fee structures. By examining alternatives, users can potentially find options with lower transaction fees, better exchange rates, or no monthly charges, thereby saving money in the long run.

Enhanced Features

While Revolut offers a wide array of services, other platforms might provide additional features or more advanced tools that better suit your needs. For instance, some alternatives might have superior budgeting tools, investment options, or customer service.

Security and Reliability

Security is a paramount concern in financial services. Comparing alternatives allows users to evaluate the security measures and reliability of different platforms, ensuring their money and personal information are protected.

User Experience

User interface and experience can vary significantly between platforms. Some alternatives might offer a more intuitive design, faster transactions, or better mobile app performance, enhancing overall user satisfaction.

Backup Options

Relying on a single financial platform can be risky if that service experiences downtime or other issues. Having alternative options ensures that users can still manage their finances seamlessly without disruption.

Regulatory and Compliance Differences

Different platforms operate under various regulatory environments, which can impact the services they provide and their reliability. Exploring alternatives helps users understand these differences and choose a platform that aligns with their compliance and regulatory preferences.

Competitive Landscape

The fintech industry is highly competitive, with new players continually entering the market. Exploring alternatives keeps users informed about the latest innovations and improvements, ensuring they benefit from the most advanced and efficient financial solutions available.

Specific Use Cases

Certain platforms may cater better to specific use cases, such as international business transactions, personal budgeting, or high-frequency trading. Identifying alternatives helps users find the best fit for their particular financial activities.

Personal Preferences

Lastly, personal preferences in terms of interface design, customer support quality, and additional perks (like cashback or rewards) can make a significant difference in user satisfaction. Exploring alternatives allows users to find a platform that feels right for them on a personal level.

Why Consider Revolut Alternatives?

Common Pain Points with Revolut

Customer Service Issues

- Users have reported delays in getting responses and resolving issues through Revolut’s customer support, especially during high-traffic periods or complex problem scenarios.

Account Freezes and Closures

- Some users experience sudden account freezes or closures, often for security reviews, which can be disruptive and stressful, particularly if funds are inaccessible during the review process.

Fees and Limits

- Although Revolut promotes fee-free services, there are certain limits and conditions where fees apply, such as exceeding the monthly free ATM withdrawal limit or making currency exchanges beyond a certain threshold.

Technical Glitches

- Like any digital platform, Revolut can suffer from technical issues or app bugs, which might affect transaction processing, app performance, or access to services.

Limited Features in Basic Plans

- Some of the more advanced features and benefits are only available in the paid plans (Plus, Premium, Metal), which might not justify the cost for all users.

Regional Restrictions

- Certain features and services offered by Revolut are not available in all countries, limiting its usability for some international users.

Benefits of Diversifying Financial Apps

Risk Mitigation

- Diversifying financial apps reduces dependency on a single platform, minimizing risks associated with account issues, technical failures, or service disruptions.

Access to Unique Features

- Different apps provide various features. By using multiple platforms, users can leverage the best tools and services each has to offer, such as specialized investment options, better budgeting tools, or unique rewards programs.

Cost Savings

- Some alternatives might offer lower fees or more favorable terms for specific transactions or services, helping users save money.

Enhanced Security

- Using multiple platforms can improve security. If one platform experiences a security breach, the impact on the user’s overall financial health is mitigated as not all assets are concentrated in one place.

Optimized User Experience

- Different apps have varying interfaces and user experiences. By trying out alternatives, users can find the most intuitive and user-friendly platforms that suit their personal preferences.

Better Customer Support

- Some alternatives might provide superior customer service, with quicker response times and more effective issue resolution.

Specialized Services

- Certain apps might be better suited for specific needs, such as high-frequency trading, international money transfers, or advanced analytics and reporting.

Backup Options

- Having multiple financial apps ensures users have backup options if one app is down or facing issues, allowing seamless financial management without interruption.

Broader Acceptance

- Different financial apps might be more widely accepted in different regions or among different merchants and service providers, offering greater flexibility.

Innovation and Trends

Staying informed about and using various fintech platforms keeps users abreast of the latest trends and innovations in financial technology, ensuring they benefit from the most advanced tools available.

Key Features to Look for in Alternatives to Revolut

Multi-Currency Accounts

Ease of Use

- Look for platforms that allow seamless holding and exchanging of multiple currencies within a single account.

- Ensure the platform offers competitive exchange rates and minimal fees for currency conversion.

Global Accessibility

- Check if the alternative supports a wide range of currencies, especially those you frequently deal with.

- Consider whether the platform is accessible and fully functional in your country of residence.

Fee Structures

Transparency

- Opt for platforms that are clear and upfront about their fee structures, including transaction fees, withdrawal fees, and any hidden charges.

- Compare the overall costs, including monthly maintenance fees and fees for specific services like international transfers.

Cost Efficiency

- Evaluate whether the platform offers competitive rates compared to Revolut, especially for services you often use, such as ATM withdrawals, currency exchanges, or overseas transactions.

Security Measures

Regulation and Compliance

- Ensure the platform is regulated by reputable financial authorities and complies with industry standards for security and privacy.

- Look for features like two-factor authentication, biometric login options, and encryption for transactions.

Fraud Prevention

- Check if the platform offers robust fraud detection and prevention mechanisms.

- Consider platforms that provide instant notifications for transactions and suspicious activity alerts.

Additional Features

Budgeting Tools

- Choose platforms that offer comprehensive budgeting tools to track your spending, set financial goals, and manage your finances effectively.

- Look for features like spending analytics, expense categorization, and custom budget settings.

Cryptocurrency Support

- If you are interested in cryptocurrencies, ensure the platform supports buying, selling, and holding cryptocurrencies securely.

- Evaluate the variety of cryptocurrencies offered and the associated fees for trading and withdrawals.

Read more about Cryptocurrencies in our article How does Cryptocurrency work?

Investment Options

- Some alternatives might offer advanced investment options such as stock trading, mutual funds, or savings plans.

- Check if these services are integrated into the platform and assess their usability and cost-effectiveness.

Customer Support

- Reliable and accessible customer support is crucial. Look for platforms that offer multiple support channels, including live chat, phone support, and email.

- Check user reviews to gauge the effectiveness and responsiveness of the support team.

You may also like to read What is Chatbot?

Additional Perks

- Consider any extra benefits that the platform might offer, such as cashback rewards, insurance coverage, or travel-related perks like discounted airport lounge access.

Top Revolut Alternatives

N26

Key Features

- Multi-Currency Accounts: N26 offers support for multiple currencies, making it easy for users to manage international finances.

- Real-Time Spending Notifications: Users receive instant notifications for every transaction.

- Integrated Budgeting Tools: The app includes features to track and categorize spending, set budgets, and monitor financial health.

- Travel Insurance and Perks: N26 provides various travel-related benefits with their premium accounts.

Pricing and Fees

- Standard Account: Free, with no monthly fees.

- Premium Accounts: Options like N26 You and N26 Metal with fees ranging from €9.90 to €16.90 per month, offering additional benefits such as insurance and premium customer support.

- ATM Withdrawals: Free within the Eurozone, fees apply outside.

User Demographics

- Target Audience: Frequent travelers, digital nomads, and individuals seeking a modern, app-based banking experience.

- Geographical Reach: Primarily available in Europe and the US.

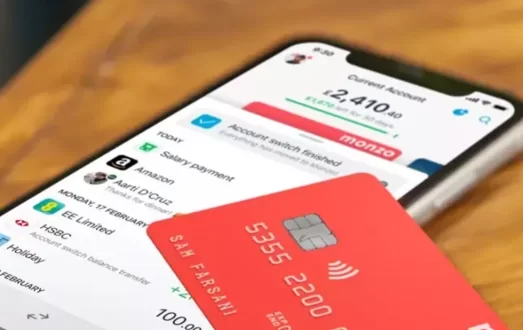

Monzo

Key Features

- Instant Spending Alerts: Users get real-time notifications for transactions.

- Budgeting Tools: Monzo offers detailed budgeting features to help users manage their finances.

- Fee-Free Foreign Transactions: No fees for spending abroad.

- Overdrafts and Loans: Available to eligible users.

Pricing and Fees

- Standard Account: Free with basic features.

- Monzo Plus and Monzo Premium: Fees of £5 and £15 per month, respectively, offering benefits like interest on balances, enhanced budgeting tools, and travel insurance.

- ATM Withdrawals: Free in the UK, fees may apply for international withdrawals.

User Demographics

- Target Audience: Young professionals, tech-savvy individuals, and people looking for flexible banking solutions.

- Geographical Reach: Predominantly in the UK, with expanding services in the US.

Discover more about Monzo in our article How Does Monzo Work

TransferWise (Wise)

Key Features

- Multi-Currency Accounts: Hold and convert over 50 currencies with competitive exchange rates.

- Borderless Account: Facilitates international business and personal transactions.

- Low Transfer Fees: Transparent and lower fees for international money transfers.

- Real-Time Notifications: Instant alerts for transactions.

Pricing and Fees

- Account Maintenance: Generally free with no hidden charges.

- Transfer Fees: Vary based on the amount and currency but are typically lower than traditional banks.

- ATM Withdrawals: Free up to a certain limit, fees apply thereafter.

User Demographics

- Target Audience: Expats, freelancers, and businesses with international financial needs.

- Geographical Reach: Global presence, supporting users from various countries.

Starling Bank

Key Features

- No Monthly Fees: Offers a free standard current account with no monthly charges.

- Overdraft and Loan Options: Competitive rates for overdrafts and personal loans.

- Multi-Currency Accounts: Available for business accounts.

- Comprehensive Budgeting Tools: Advanced features for tracking and managing spending.

Pricing and Fees

- Standard Account: Free with no monthly maintenance fees.

- Business Accounts: Fees apply for additional services like multi-currency handling.

- ATM Withdrawals: Free in the UK, fees may apply abroad.

User Demographics

- Target Audience: UK residents, including personal and business users looking for digital banking solutions.

- Geographical Reach: Primarily in the UK.

Chime

Key Features

- No Monthly Fees: Free basic banking with no maintenance fees.

- Early Direct Deposit: Get paid up to two days early with direct deposit.

- Automatic Savings: Automatically save a percentage of every paycheck.

- Fee-Free Overdraft: SpotMe feature allows for fee-free overdrafts up to a certain limit.

Pricing and Fees

- Standard Account: Free with no monthly charges.

- ATM Withdrawals: Free at in-network ATMs, fees apply for out-of-network transactions.

- Overdraft Fees: No fees for overdrafts within the SpotMe limit.

User Demographics

- Target Audience: US residents, particularly millennials and those seeking a fee-free banking experience.

- Geographical Reach: Available only in the United States.

Emerging Competitors of Revolut

Curve

Unique Features

- All-in-One Card: Combines multiple bank cards into one Curve card for easier spending management.

- Go Back in Time: Allows users to switch charges between different payment methods after a purchase.

- Curve Rewards: Earn cashback rewards at selected retailers.

Market Positioning

- Target Audience: Tech-savvy individuals seeking streamlined banking solutions.

- Geographical Reach: Primarily in Europe, expanding to other regions.

Bunq

Unique Features

- Green Card: Eco-friendly banking option with contributions made to reforestation projects.

- Travel Card: Zero foreign exchange fees on international spending.

- Easy Bank Account Switching: Helps users seamlessly switch from their current bank to Bunq.

Market Positioning

- Target Audience: Environmentally conscious consumers and travelers.

- Geographical Reach: Available across Europe, focusing on sustainability and innovation.

Varo

Unique Features

- No Fee Banking: No monthly maintenance fees, no minimum balance requirement.

- Early Direct Deposit: Get paid up to two days early with direct deposit.

- Save Your Pay: Automatically save a percentage of your paycheck.

Market Positioning

- Target Audience: US residents looking for fee-free banking and automated savings options.

- Geographical Reach: Available throughout the United States.

Comparison of Revolut Alternatives

| Feature | Revolut | N26 | Monzo | TransferWise (Wise) | Chime |

|---|---|---|---|---|---|

| Type of Service | Digital Bank | Digital Bank | Digital Bank | International Money Transfers | Neobank |

| Founded | 2015 | 2013 | 2015 | 2011 | 2013 |

| Headquarters | London, UK | Berlin, Germany | London, UK | London, UK | San Francisco, USA |

| Availability | Global | Europe, US | UK | Global | US |

| Currencies Supported | 30+ | 20 | 1 (GBP) | 50+ | 1 (USD) |

| Account Types | Standard, Premium, Metal | Standard, Premium, Metal | Standard, Premium | Borderless Account | Standard, Savings |

| Key Features | Multi-currency accounts, crypto trading, stock trading, budgeting tools | Fee-free spending abroad, mobile payments, insurance | Fee-free spending abroad, savings pots, budgeting tools | Low-cost international transfers, multi-currency accounts | No monthly fees, early direct deposit, automatic savings |

| Fee Structure | Free basic accounts; subscription for premium features | Free basic accounts; subscription for premium features | Free basic accounts; subscription for premium features | Fee per transfer; subscription for additional features | No monthly fees; fees for out-of-network ATM withdrawals |

| Customer Support | In-app chat, and phone support for premium users | In-app chat, and phone support for premium users | In-app chat, phone support for premium users | In-app chat, email support | In-app chat, phone support |

| Security | High (2FA, instant freeze, disposable cards) | High (2FA, instant freeze, biometric login) | High (2FA, instant freeze, biometric login) | High (2FA, instant freeze, biometric login) | High (2FA, instant freeze, biometric login) |

How to Choose the Right Alternative for You

1. Assessing Your Financial Needs

- Transaction Habits: Evaluate how often you make international transactions or use ATMs to understand potential fees.

- Currency Requirements: Consider if you frequently deal with multiple currencies and need competitive exchange rates.

- Budgeting and Saving Goals: Determine if you require robust budgeting tools or automated savings features.

2. Matching Features to Your Requirements

- Fee Structure: Compare account fees, ATM withdrawal fees, and foreign transaction fees across different alternatives.

- Security Features: Review security measures such as two-factor authentication and insurance coverage for peace of mind.

- Additional Features: Look for specific features like budgeting tools, investment options, or business solutions that align with your needs.

3. Considering Customer Service and Support

- Availability: Check the availability of customer support channels (e.g., phone, email, live chat) and their responsiveness.

- User Reviews: Read user reviews and feedback to gauge the quality of customer service and support provided by each alternative.

- Community and Resources: Evaluate if the alternative offers community forums, educational resources, or helpful guides for users.

4. Final Considerations

- Trial Period: If available, take advantage of any trial periods or demo accounts to experience the platform firsthand.

- Long-Term Suitability: Assess how well the alternative aligns with your long-term financial goals and lifestyle.

TL; DR-Revolut Alternatives: All you need to know about Apps like Revolut

Exploring alternatives to Revolut opens up a spectrum of choices tailored to diverse financial needs. Whether prioritizing low fees, robust features, or exceptional customer support, each alternative offers distinct advantages. By assessing your specific requirements be it multi-currency capabilities, budgeting tools, or unique banking features you can confidently select an alternative that aligns with your financial goals. Remember to consider user experiences, security measures, and long-term suitability to ensure a seamless transition and an enriched banking experience tailored to your preferences.

Want to Launch Your Own Business Similar to Fintech?

If you want to start your own fintech platform – you should go with Fintech Script which has customized features to let you roll with your own fintech platform business.