Welcome to the world of fintech! In this article, we’ll delve into the realm of financial technology, exploring what is Fintech, how it works, and how you can leverage it in 2024. Whether you’re new to the concept or seeking to expand your knowledge, this guide will equip you with everything you need to know.

What is Fintech?

Fintech, short for financial technology, refers to the innovative use of technology to deliver financial services efficiently. It encompasses a wide range of applications, from mobile banking and payment solutions to robo-advisors and cryptocurrency platforms. At its core, Fintech aims to streamline processes, enhance accessibility, and improve the overall customer experience within the financial sector.

What is the purpose of Fintech?

The purpose of fintech, or financial technology, is to leverage innovative technologies to improve and streamline financial services and processes. Fintech aims to make financial services more accessible, efficient, and affordable for individuals, businesses, and institutions. Key purposes of fintech include:

- Enhancing Financial Inclusion: Fintech strives to expand access to financial services for underserved populations. It includes the unbanked and underbanked, by leveraging technology to provide convenient and affordable banking solutions.

- Improving Customer Experience: Fintech focuses on enhancing the customer experience by offering user-friendly interfaces, personalized services, and seamless digital interactions. It ultimately makes financial transactions easier and more convenient for users.

- Driving Innovation: Fintech drives innovation by introducing new products, services, and business models that challenge traditional banking practices and reshape the financial landscape. This includes innovations such as mobile payments, robo-advisors, peer-to-peer lending platforms, and blockchain technology.

- Lowering Costs: Fintech aims to reduce the costs associated with financial services by leveraging technology to automate processes, streamline operations, and eliminate the need for physical infrastructure, ultimately making financial services more affordable for consumers and businesses.

- Increasing Efficiency: Fintech improves the efficiency of financial processes by digitizing and automating tasks, reducing paperwork, and minimizing manual errors. In addition to faster transaction processing times, quicker access to funds, and improved overall efficiency in financial operations.

- Enabling Financial Planning and Management: Fintech tools and platforms empower individuals and businesses to better manage their finances, track expenses, budget effectively, and make informed financial decisions through the use of data analytics, artificial intelligence, and machine learning algorithms.

History and Evolution of Fintech

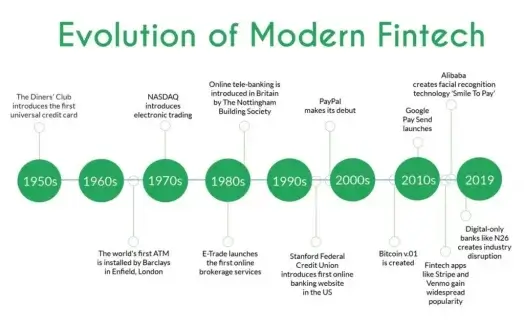

Fintech’s journey traces back to the 1950s when the nascent stage of electronic payment systems and credit cards laid the groundwork for digitizing financial transactions.

The 1960s and 1970s witnessed a significant milestone with the advent of automated teller machines (ATMs), offering customers unprecedented access to banking services round-the-clock.

By the 1980s and 1990s, the rise of online banking marked a pivotal shift, empowering customers to manage their accounts, transfer funds, and pay bills electronically through personal computers and the Internet. This era also saw the emergence of e-commerce and online payment gateways, facilitating secure online transactions and fostering the growth of internet-based businesses.

Read more about e-commerce in our article; how does e-commerce work, insights into e-commerce business model, revenue model of e-commerce industry

The early 2000s brought mobile banking and payments to the forefront, as smartphones and mobile apps enabled users to conduct financial transactions on-the-go. Meanwhile, the mid-2000s witnessed the rise of peer-to-peer lending platforms, disrupting traditional banking models by directly connecting borrowers with investors and offering competitive loan terms.

The late 2000s and early 2010s saw the advent of blockchain technology and cryptocurrencies like Bitcoin, ushering in an era of decentralized finance and challenging traditional banking systems.

In recent years, the fintech ecosystem has expanded rapidly, encompassing a diverse array of innovative technologies and services, including robo-advisors, crowdfunding platforms, and digital wallets. Moreover, fintech startups have increasingly collaborated with traditional banks, leading to the emergence of “fintech banks” and hybrid financial services models that combine innovation with regulatory compliance.

Importance of Fintech

- Enhanced Accessibility: Fintech widens access to financial services, especially for underserved populations, by leveraging technology to offer convenient and affordable banking solutions.

- Improved Efficiency: Fintech streamlines financial processes through automation, reducing paperwork, and minimizing manual errors, resulting in faster transaction processing times and quicker access to funds.

- Increased Innovation: Fintech drives innovation by introducing new products, services, and business models, challenging traditional banking practices, and reshaping the financial landscape.

- Empowerment through Education: Fintech platforms provide tools and resources for financial management and decision-making, promoting financial literacy and empowering individuals to take control of their finances.

- Fostering Economic Growth: Fintech stimulates economic growth by facilitating faster, more secure transactions, supporting entrepreneurship, and creating new investment opportunities.

What are the features of Fintech?

- Innovative Solutions: Fintech offers cutting-edge solutions and services that leverage technology to address financial challenges and meet evolving customer needs.

- User-Centric Design: Fintech platforms prioritize user experience, offering intuitive interfaces and personalized services to enhance customer satisfaction.

- Digital Payments: Fintech enables secure and convenient digital payment methods, such as mobile wallets, peer-to-peer transfers, and contactless transactions, revolutionizing the way people conduct financial transactions.

- Robust Security: Fintech employs advanced encryption techniques and security measures to safeguard sensitive financial information and protect against cyber threats and fraud.

- Data Analytics: Fintech utilizes big data analytics and machine learning algorithms to analyze vast amounts of data, providing insights for better decision-making, risk assessment, and personalized financial advice.

Fintech’s Role in Sustainable Growth

- Embrace Responsible Innovation: Fintechs should prioritize responsible innovation, ensuring that their products and services meet ethical, social, and environmental standards. This involves considering the broader impact of their solutions on stakeholders and the environment.

- Focus on Financial Inclusion: Fintechs can promote sustainable growth by expanding access to financial services for underserved populations, including the unbanked and underbanked. By offering inclusive solutions tailored to the needs of marginalized communities, fintechs can drive economic empowerment and social progress.

- Integrate Environmental, Social, and Governance (ESG) Criteria: Fintechs should integrate ESG criteria into their business strategies, incorporating environmental, social, and governance factors into decision-making processes. This entails considering environmental sustainability, social impact, and corporate governance practices in all aspects of operations.

- Offer Sustainable Investment Solutions: Fintechs can facilitate sustainable growth by offering innovative investment products and platforms that prioritize environmental and social impact. This includes promoting responsible investing, supporting renewable energy projects, and facilitating green financing initiatives.

- Promote Financial Literacy and Education: Fintechs should prioritize financial literacy and education initiatives to empower individuals and businesses to make informed financial decisions. By providing educational resources and tools, fintechs can foster a culture of financial responsibility and sustainability.

Read more: Future of Fintech

Fintech company

A fintech company leverages technology to offer innovative financial services, improving accessibility, efficiency, and user experience. These companies often disrupt traditional financial sectors by introducing digital solutions such as mobile payments, peer-to-peer lending, and blockchain technology. Examples of fintech companies include PayPal, known for its online payment systems, and Robinhood, which revolutionized stock trading with its commission-free trading platform.

How Does Fintech Work?

Fintech operates through various technological advancements such as artificial intelligence, blockchain, and data analytics. These technologies enable financial institutions, startups, and other entities to offer a diverse array of services, including:

Digital Payments: With the rise of mobile wallets and contactless payment methods, fintech has revolutionized the way we transact, making payments faster, more secure, and more convenient.

Online Lending: Fintech platforms facilitate peer-to-peer lending, crowdfunding, and online loans, providing individuals and businesses with alternative sources of financing outside traditional banking channels.

Investment Management: Robo-advisors and algorithmic trading platforms utilize AI and machine learning algorithms to automate investment decisions, offering personalized advice and portfolio management services to investors.

List of Popular Fintech Apps

Here are some of the well-known and popular fintech apps and startups across categories:

Payments

- PayPal: PayPal is a widely used online payment platform that enables individuals and businesses to send and receive payments securely over the Internet.

- Square: Square offers a range of financial services and software solutions for businesses, including point-of-sale systems, payment processing, and small business loans.

- Stripe: Stripe is a technology company that provides online payment processing for Internet businesses, enabling them to accept payments from customers around the world.

- TransferWise (now Wise): Wise is a money transfer service that allows users to send money internationally at a lower cost than traditional banks, using real exchange rates and transparent fees.

If you want to know more about how these Fintech apps work; we have the following articles-

Trading & Investment

- Robinhood: Robinhood is a commission-free trading app that allows users to buy and sell stocks, ETFs, options, and cryptocurrencies without paying traditional brokerage fees.

Know more about how Robinhood makes money –How does Robinhood make money

- StashInvest: StashInvest is an investment app that offers personalized financial guidance and allows users to easily invest in stocks, ETFs, and retirement accounts for as little as $5.

Find out more about how does StashInvest work

Digital Banking & Finance

- Revolut: Revolut is a digital banking app that offers a range of financial services, including currency exchange, international money transfers, and cryptocurrency trading.

- Klarna: Klarna is a “buy now, pay later” service that enables users to shop online and pay for their purchases in installments, interest-free or with financing options.

Know more about how Klarna works; how does Klarna work

- Credit Karma: Credit Karma is a financial management platform that provides users with free credit scores, credit monitoring, and personalized recommendations for improving their financial health.

Read more about how Credit Karma works; how does Credit Karma work

- SoFi: SoFi (Social Finance) offers a range of financial products and services, including personal loans, student loan refinancing, mortgage loans, investment management, and more.

- Chime: Chime is a neobank that offers fee-free checking and savings accounts, along with other financial services like early direct deposit, automatic savings, and no overdraft fees.

- Plaid: Plaid is a financial technology company that provides APIs for connecting bank accounts and financial data to apps and services, enabling developers to build innovative financial products and services.

- Afterpay: Afterpay is a “buy now, pay later” platform that allows users to make purchases and pay for them in installments over time without interest.

Explore more about how Afterpay works; how does Afterpay work

- Monzo: Monzo is a digital bank that offers a range of financial services, including current accounts, budgeting tools, and money management features, all accessible through a mobile app

Discover how Monzo works and learn more about its features and services in our detailed guide on how does Monzo work.

-> Check out the list of Financial Services App Development Companies

Cryptocurrency

Coinbase: Coinbase is a popular cryptocurrency exchange platform that allows users to buy, sell, and store a variety of digital currencies, including Bitcoin, Ethereum, and Litecoin.

Find out how Cryptocurrency works; How does Cryptocurrency work

Crowdfunding

Main article– How does crowdfunding work

Crowdfunding is a method of raising funds for a project, cause, or business venture by collecting small contributions from a large number of people, typically via online platforms. It allows individuals, startups, and organizations to reach a broad audience and secure the necessary financial support to bring their ideas to life. Crowdfunding not only provides financial backing but also helps validate concepts, build a community of supporters, and create buzz around a project before it even launches.

- Kickstarter: Kickstarter is a crowdfunding platform that enables creators to raise funds for creative projects, products, and ideas by soliciting pledges from backers.

Explore how Kickstarter works in our detailed guide on how does Kickstarter work

- Indiegogo: Indiegogo is another crowdfunding platform that allows individuals to raise funds for projects, products, and causes through online campaigns, offering various perks or rewards to backers who contribute.

Know more about how IndieGoGo works in our article; how does Indiegogo work

These fintech apps and startups have gained significant popularity and recognition for their innovative solutions in the financial services industry.

Fintech products

Fintech products are digital tools and services that enhance or streamline financial activities through technology. These products cover a wide range of financial needs, from payments and lending to investing and insurance. Here are some examples of fintech products:

- Digital Wallets: Products like PayPal, Apple Pay, and Google Wallet allow users to store and manage their money digitally, making payments online or in-store with ease.

- Peer-to-Peer (P2P) Lending Platforms: Companies like LendingClub and Prosper enable individuals to lend money to others, bypassing traditional banks and offering potentially lower interest rates.

- Robo-Advisors: Services like Betterment and Wealthfront use algorithms to provide automated, low-cost investment advice, making wealth management more accessible.

- Cryptocurrency Exchanges: Platforms like Coinbase and Binance allow users to buy, sell, and trade cryptocurrencies like Bitcoin and Ethereum.

- Insurtech Solutions: Companies like Lemonade use technology to offer fast, user-friendly insurance products, including home, renters, and pet insurance.

- Mobile Banking Apps: Banks like Chime and Revolut offer app-based banking with features like fee-free accounts, instant notifications, and budgeting tools.

Know more about how Revolut makes money in our article; How does Revolut make money

Who benefits from Fintech?

Fintech benefits a wide range of stakeholders across various sectors, including:

1. Consumers: Fintech enhances consumer experiences by offering convenient and accessible financial services. From mobile banking apps to digital payment solutions, consumers can manage their finances, make transactions, and access credit more efficiently.

2. Small Businesses: Fintech levels the playing field for small businesses by providing access to affordable financing options, streamlined payment processing, and digital accounting solutions. This enables small businesses to compete with larger enterprises and expand their operations.

3. Financial Institutions: Traditional financial institutions can leverage fintech to improve operational efficiency, reduce costs, and enhance customer satisfaction. By adopting digital banking platforms, automated processes, and data analytics tools, banks and credit unions can stay competitive in a rapidly evolving market.

4. Investors: Fintech offers investors access to a diverse range of investment opportunities, from stocks and bonds to cryptocurrencies and alternative assets. Robo-advisors and online trading platforms provide investors with personalized advice, low-cost investment options, and real-time market insights.

5. Regulators: Fintech presents regulatory challenges and opportunities for government agencies and regulatory bodies. Regulators play a crucial role in ensuring consumer protection, maintaining market integrity, and fostering innovation within the fintech ecosystem through proactive regulation and oversight.

6. Developing Countries: Fintech has the potential to drive financial inclusion and economic development in developing countries by providing underserved populations with access to basic financial services. Mobile banking, digital wallets, and microfinance platforms enable individuals in remote areas to participate in the formal financial system, save money, and access credit.

Impact of Fintech on Traditional Banking

Fintech has profoundly reshaped traditional banking, fostering intense competition and driving innovation across the industry. With a relentless focus on digital convenience and user-centric design, fintech firms have revolutionized the customer experience, offering seamless and personalized banking services through mobile apps and online platforms.

By leveraging technology to operate with lower overhead costs, fintech companies have disrupted traditional banking fee structures, prompting traditional banks to reevaluate their pricing strategies and enhance efficiency. Moreover, fintech’s introduction of innovative products and services, such as peer-to-peer lending and digital wallets, has expanded the range of financial options available to consumers.

Fintech has played a pivotal role in promoting financial inclusion and providing access to banking services for underserved populations through mobile banking and digital payment solutions. However, this rapid transformation has also presented regulatory challenges, as regulators strive to balance fostering innovation with safeguarding consumer protection and financial stability.

Check out the list of top financial software development companies.

Utilizing Fintech in 2024

As we navigate the evolving landscape of financial technology in 2024, there are several ways you can harness its potential:

Embrace Digital Banking: Opt for digital banking solutions that offer features such as mobile check deposits, budgeting tools, and real-time account notifications for a seamless banking experience.

Explore Cryptocurrency: Consider investing in cryptocurrencies or exploring blockchain-based platforms for decentralized finance (DeFi) opportunities, but do so cautiously, understanding the risks involved.

Stay Informed: Keep abreast of emerging fintech trends and developments, such as central bank digital currencies (CBDCs), regulatory changes, and advancements in cybersecurity, to make informed decisions.

TL;DR – What is Fintech?

Fintech, or financial technology, uses innovative tech to improve financial services, making them more accessible, efficient, and affordable. It enhances financial inclusion, improves customer experience, drives innovation, lowers costs, and increases efficiency. Fintech’s history spans from the 1950s to today, evolving through electronic payments, online banking, mobile payments, blockchain, and cryptocurrencies.

Fintech benefits consumers, small businesses, financial institutions, investors, regulators, and developing countries. It has transformed traditional banking, offering digital convenience, personalized services, and expanded financial options. In 2024, embrace digital banking, explore cryptocurrency cautiously, and stay informed about fintech trends and developments

Building a Fintech Startup?

Get advice from our experienced team building award-winning Fintech products and scaling successful startups for over 20 years. Contact us today for a free quote on your Fintech software development project.

How did you find this article? Tell us in the comments section and share this article on your blog or social media to spread the word. Thank you for reading.