Step into the realm of fintech with Revolut! In this guide, we’ll explore what is Revolut? and how it works. Whether you’re a newcomer or a seasoned user, this article will provide all the insights you need to maximize your experience with Revolut.

What is Revolut?

Revolut is a financial technology (fintech) company that offers a wide range of banking and financial services through its mobile app. Founded in 2015 Revolut began with the goal of providing a more affordable and efficient way to manage money, especially when it comes to currency exchange. Since then, it has expanded significantly, offering various services that cater to different financial needs.

History and Background of Revolut

Nikolay Storonsky and Vlad Yatsenko founded Revolut in 2015 to revolutionize banking by eliminating inefficiencies and high costs. They started with a prepaid Mastercard and a mobile app, offering competitive exchange rates and low-cost international transfers, which quickly gained popularity among travelers and expatriates.

Over the years, Revolut expanded its services to include multi-currency accounts, peer-to-peer payments, budgeting tools, cryptocurrency trading, stock trading, insurance products, and premium subscription plans. Despite regulatory challenges, Revolut grew rapidly, amassing over 15 million users by 2021 and achieving a valuation exceeding $5 billion. Today, Revolut remains a leader in fintech, committed to democratizing finance and empowering individuals to take control of their money.

Explore more about Fintech in our article What is Fintech?

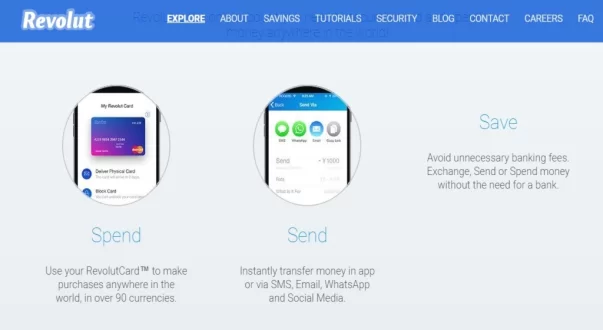

Key Features of Revolut

Multi-Currency Accounts

One of Revolut’s standout features is its ability to hold and manage multiple currencies. Users can exchange currencies at interbank rates, which are typically better than the rates offered by traditional banks. This feature is particularly beneficial for travelers and people who conduct business internationally.

Debit Card

Revolut provides both physical and virtual debit cards. These cards can be used for everyday purchases, online shopping, and ATM withdrawals worldwide. The cards are linked to the Revolut app, allowing users to easily manage their spending and monitor transactions in real-time

Payments and Transfers

Revolut simplifies the process of sending and receiving money. Users can transfer money to other Revolut users instantly and for free. Additionally, Revolut offers international money transfers at lower fees compared to traditional banks, making it a cost-effective solution for sending money abroad.

Budgeting and Analytics

The app includes budgeting tools that help users track their spending and manage their finances more effectively. With features like spending analytics, users can see where their money is going and set monthly budgets. Instant notifications for every transaction also help users stay on top of their spending.

Cryptocurrency and Stock Trading

Revolut allows users to buy, hold, and sell cryptocurrencies such as Bitcoin, Ethereum, and others. The app also supports stock trading, enabling users to invest in a range of companies. This feature makes it easy for users to diversify their investments without needing separate accounts for different types of assets.

Learn more about Cryptocurrency in our article How does cryptocurrency work

Revolut Bank UAB

Revolut Bank UAB is the banking entity of Revolut, operating under a European banking license. Based in Lithuania, UAB provides additional financial services and protections to its users, such as deposit insurance, making it a more secure option for customers. This expansion allows Revolut to offer a broader range of traditional banking services, complementing its fintech innovations and enhancing its position in the competitive financial services market.

Revolut vs. Traditional Banks

Here is a comparison of Revolut’s features with traditional banking services.

| Feature | Revolut | Traditional Banks |

|---|---|---|

| Account Setup | Quick and easy via mobile app | Often requires visiting a branch |

| Currency Exchange | Competitive rates, real-time exchange | Typically higher fees, slower processes |

| International Transfers | Low-cost, fast transfers | Higher fees, slower processing times |

| Multi-Currency Accounts | Available | Limited availability |

| Peer-to-Peer Payments | Instant and free | May incur fees, slower |

| Cryptocurrency Trading | Available within the app | Generally not available |

| Stock Trading | Available within the app | Limited to specific banks |

| Budgeting Tools | Integrated in the app | Often third-party tools or not available |

| Insurance Products | Available through the app | Available, typically through separate policies |

| Premium Subscription Plans | Offers additional perks and benefits | Limited availability |

| Customer Support | Primarily app-based, online chat support | In-branch, phone support |

| Interest on Savings | Limited interest options | Generally higher interest on savings accounts |

| ATM Withdrawals | Free up to a certain limit, then fees apply | Free or low-cost, depends on the bank |

| Compliance and Regulation | Some regulatory challenges | Well-established compliance practices |

| Global Presence | Rapid global expansion | Established but varies by bank |

Pros and Cons of Using Revolut Bank Over a Conventional Bank

Pros of Using Revolut

Cost-Effective

Lower fees for transactions, currency exchanges, and international transfers can save you money.

Convenience

Access to advanced features like budgeting tools, spending analytics, and instant notifications on your mobile device.

Global Accessibility

Multi-currency accounts and low-cost international transfers make it easy to manage finances across borders.

Innovative Features:

Options for cryptocurrency trading, stock trading, and savings vaults provide opportunities for investment and savings.

Cons of Using Revolut

Regulatory Challenges

Revolut may face regulatory hurdles or restrictions in certain regions, affecting its services.

Limited Physical Presence

Unlike traditional banks with physical branches, Revolut primarily operates online, which may not suit everyone’s preferences

Risk of Cybersecurity Threats

As with any online service, there is a risk of cybersecurity threats such as hacking or data breaches, although Revolut implements security measures to mitigate these risks.

Revolut’s Multi-Currency Feature

Revolut’s multi-currency feature is designed to offer flexibility, cost savings, and ease of use, making it an excellent choice for anyone needing to manage multiple currencies efficiently. Whether you’re traveling, shopping online in foreign currencies, or holding different currencies for business purposes, Revolut simplifies the process and ensures you get the best rates available.

How to Hold and Exchange Multiple Currencies

Adding Currencies

- Open the Revolut app and navigate to the “Accounts” section.

- Tap on “Add Currency” and choose from a list of supported currencies.

- Once added, you can view and manage multiple currencies within your account.

Exchanging Currencies

- Go to the “Exchange” section in the app.

- Select the currencies you want to exchange from and to (e.g., USD to EUR).

- Enter the amount you wish to exchange.

- Review the exchange rate and confirm the transaction.

- The exchanged amount will be credited to the respective currency account instantly.

Using Multi-Currency Accounts

- When making a purchase or withdrawing cash, Revolut will automatically use the local currency if you have it in your account.

- This helps avoid additional fees and poor exchange rates typically applied by traditional banks.

Understanding Interbank Exchange Rates

What Are Interbank Exchange Rates?

- Interbank exchange rates are the rates at which banks trade currencies with each other.

- These rates are typically more favorable than the rates offered to retail customers by traditional banks and currency exchange services.

Revolut’s Exchange Rates:

- Revolut offers access to interbank exchange rates for most currency conversions.

- This means you get a better deal on currency exchanges, with minimal or no markups compared to traditional banking services.

Exchange Rate Transparency:

- Revolut provides real-time exchange rate information within the app.

- You can see the exact rate you’ll receive before confirming a transaction, ensuring transparency and control over your exchanges.

Benefits of Using Revolut for Currency Exchange

Cost Savings

- By offering interbank exchange rates, Revolut helps you save money on currency exchanges, especially when compared to traditional banks and airport exchange bureaus that charge high fees and offer poor rates.

Convenience and Flexibility

- Manage multiple currencies from a single account without the need for separate bank accounts.

- Easily switch between currencies with a few taps in the app, making it ideal for frequent travelers or those dealing with multiple currencies.

No Hidden Fees

- Revolut is transparent about its fees. While some transactions might incur a small fee (e.g., exchanging large amounts on weekends), these fees are clearly displayed before you confirm the transaction.

- There are no hidden charges, ensuring you know exactly what you’re paying for.

Seamless International Transactions

- Spend and withdraw cash in local currencies without incurring additional fees, as long as you have the currency in your account.

- This feature is especially beneficial for travelers and expatriates who regularly deal with different currencies.

Real-Time Notifications

- Receive instant notifications for currency exchanges, helping you stay informed about your transactions and manage your finances effectively.

Revolut Alternatives

Discover more about alternatives to revolut in Revolut Alternatives an article by our team

When considering alternatives to Revolut, there are several standout options to suit various financial needs. Monzo stands out with its intuitive app, offering useful features such as budgeting tools and real-time notifications. N26 is another solid choice, renowned for its sleek interface and strong international banking features. For those looking for a complete digital banking solution, Chime offers benefits like fee-free banking and automatic savings. Each of these options presents distinct advantages, helping users choose the platform that best aligns with their financial goals and preferences.

Explore more about Monzo in our article How does Monzo work.

How Does Revolut Work?

People who get to learn about Revolut often have questions like “How does Revolut work?”. You can make an account at Revolut within 60 seconds and enjoy the vast array of features it offers. Revolut allows users to hold and handle 25 currencies while allowing you to spend abroad with no fees in over 130 currencies with Visa or Mastercard. It provides you with instant spending notifications and helps you budget your expenses.

The application has been designed to be highly secure and can control contactless/wireless transactions etc protecting the interests of its users at all times. It also provides device and travel medical insurance for its users, guiding them to use insurance policies for their lives. Premium accounts also have access to exclusive card designs, overseas medical insurance, airport lounges, and 24/7 customer support.

The various features offered by Revolut have attracted users in the Fintech sector to its facilities, making it grow tremendously within short periods. Money deposited in the Revolut is safeguarded at Barclays or Lloyds, guarding your money as per regulatory requirements. You will be able to claim your funds from your Revolut accounts even if Revolut becomes insolvent, ensuring the safety of your money. Revolut allows you to direct your salary directly to your bank account by setting up your IBAN and handing it over to your employer.

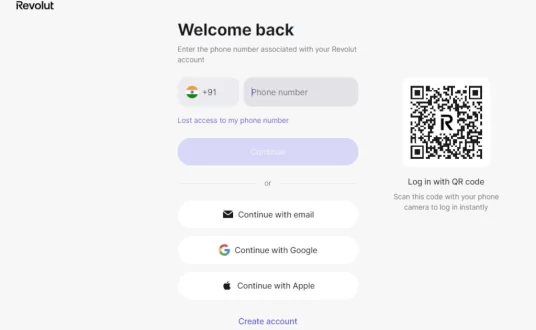

Setting Up Your Revolut Account

Download the Revolut App

Visit the App Store or Google Play Store on your mobile device and search for “Revolut.” Download and install the app.

Create an Account

Open the Revolut app and click on “Sign Up.” Enter your phone number and create a secure password for your account.

Verify Your Identity

Follow the prompts to verify your identity. You may need to provide additional information, such as your full name, date of birth, and residential address.

Choose Your Plan:

Explore the different plans available (Standard, Plus, Premium, or Metal) and choose the one that best suits your needs. Each plan offers different features and benefits, so take your time to decide.

Set Up Your Account

Once you’ve chosen a plan, you’ll need to set up your account. This may involve linking a bank account to fund your Revolut account or adding a debit or credit card.

Add Funds

To start using your Revolut account, you’ll need to add funds. You can do this by transferring money from your linked bank account or by using a debit or credit card.

Explore the App

Take some time to familiarize yourself with the Revolut app. Explore the different features, such as currency exchange, budgeting tools, and payment options.

Activate Your Card (If Applicable)

If you’ve ordered a physical Revolut card, you’ll need to activate it once it arrives. Follow the instructions on your card to complete the activation process.

You may also like to read How does Square work

Set Up Security Features

Ensure your account is secure by setting up security features such as PIN protection, fingerprint or face ID authentication, and transaction notifications.

Start Using Your Revolut Account

Congratulations! Your Revolut account is now set up and ready to use. You can start making payments, transferring money, and managing your finances with ease.

Using the Revolut Debit Card

Ordering Your Revolut Card

- Open the Revolut app and navigate to the “Cards” section.

- Choose whether you want a physical or virtual card.

- Follow the prompts to order your card, providing your delivery address if necessary.

Activating Your Card

- Once your card arrives, open the Revolut app.

- Go to the “Cards” section and find your new card.

- Tap on the card and follow the instructions to activate it.

Making Purchases

- Use your Revolut card to make purchases wherever Mastercard is accepted.

- Tap or insert your card at payment terminals, or enter your card details for online transactions.

- Transactions will be deducted directly from your Revolut account balance.

Withdrawing Cash

- You can use your Revolut card to withdraw cash from ATMs worldwide.

- Locate an ATM that accepts Mastercard and follow the instructions on the screen.

- Enter your PIN when prompted and select the amount you wish to withdraw.

Managing Your Card

- Keep track of your card transactions in the Revolut app.

- Set spending limits or freeze/unfreeze your card if needed.

- Report any lost or stolen cards immediately to protect your account.

Currency Conversion

- If you’re traveling internationally, your Revolut card automatically converts your spending into the local currency at interbank rates.

- This allows you to avoid expensive exchange fees typically charged by traditional banks.

Security Features

- Your card comes with advanced security features such as PIN protection and contactless payment limits.

- You can also enable additional security measures like location-based security or transaction notifications for added peace of mind.

Making Payments and Transfers with Revolut

Sending Money to Other Revolut Users

- Navigate to the “Payments” section in the Revolut app.

- Select “Send Money” and enter the recipient’s phone number or Revolut username.

- Enter the amount you wish to send and confirm the transaction.

- The recipient will receive the funds instantly in their Revolut account.

Making International Transfers

- Access the “Payments” section in the Revolut app.

- Select “Bank Transfer” and enter the recipient’s bank details, including IBAN and SWIFT/BIC codes.

- Enter the amount you wish to transfer and confirm the transaction.

- International transfers with Revolut are often faster and more cost-effective than traditional bank transfers.

Splitting Bills and Requesting Money from Friends

- Use the “Split Bill” feature in the Revolut app to divide expenses evenly among friends.

- Select the transactions you want to split, enter the amount each person owes, and send the request.

- Alternatively, use the “Request Money” feature to request funds directly from friends or contacts.

- Simply enter the amount you’re requesting and send the request via the app.

Managing Recurring Payments

- Set up recurring payments for bills, subscriptions, and other regular expenses.

- Navigate to the “Payments” section in the Revolut app and select “Scheduled Payments.”

- Enter the payment details, including the recipient’s information and the payment frequency.

- Revolut will automatically process the payments according to your schedule, helping you stay on top of your bills.

Security Features

- Protect your payments and transfers with Revolut’s advanced security features.

- Enable two-factor authentication (2FA) for added security when making transactions.

- Receive instant notifications for every payment or transfer, allowing you to monitor your account activity closely.

Learn more about how does revolut make money?

Revolut Pay

Revolut Pay is a digital payment solution offered by Revolut, designed to streamline online transactions for both merchants and customers. It allows users to make quick and secure payments using their Revolut account, with support for multiple currencies and seamless integration with various e-commerce platforms. For businesses, Revolut Pay provides a convenient checkout experience, reducing friction and potentially increasing conversion rates. It also leverages Revolut’s competitive exchange rates, making it an attractive option for international transactions.

Read more about e-commerce in How does e-commerce Work an article by our team

Revolut Pay Button

It is a digital payment solution that allows merchants to integrate seamless payment options on their websites. Customers can use it to pay quickly and securely using their Revolut account, streamlining the checkout process and enhancing user experience.

Security and Customer Support

Understanding Revolut’s Security Features

PIN Protection and Biometric Authentication

- Secure your Revolut account with a personal identification number (PIN) or biometric authentication such as fingerprint or face ID.

Two-factor authentication (2FA)

- Enable two-factor authentication for an extra layer of security when logging in or making transactions. This typically involves receiving a code via SMS or a third-party authenticator app.

Transaction Notifications

- Receive instant notifications for every transaction on your Revolut account, allowing you to monitor your account activity closely and detect any unauthorized transactions.

Freeze/Unfreeze Card

- Freeze or unfreeze your card instantly via the app if it’s lost or stolen. This prevents unauthorized use of your card until you locate it or order a replacement.

Location-Based Security

- Enable location-based security to prevent unauthorized transactions when your phone is not near your location. Transactions made in unfamiliar locations may trigger additional security checks.

How to Contact Revolut Customer Support

In-App Support

- Access customer support directly within the Revolut app by tapping on the “Support” tab. Here, you can browse FAQs, chat with a virtual assistant, or contact a support agent for assistance.

You may also like to read What is Chatbot

Phone Support

- If you prefer to speak with a support agent over the phone, you can find the contact number for your region within the Revolut app or website.

Email Support

- Send an email to Revolut’s customer support team if you have a non-urgent inquiry or require assistance with a specific issue. You can typically find the email address on the Revolut website or app.

What to Do If You Lose Your Card or Experience Fraud

Freeze Your Card

- If you suspect that your card has been lost, stolen, or compromised, freeze it immediately via the app to prevent unauthorized transactions.

Report Fraudulent Activity

- Contact Revolut’s customer support team as soon as possible to report any fraudulent transactions on your account. They can investigate the issue and take appropriate action to protect your account.

Order a Replacement Card

- If your Revolut card is lost or stolen, order a replacement card through the app. The new card will be delivered to your registered address, and you can activate it once it arrives.

Monitor Your Account

- Regularly monitor your Revolut account for any suspicious activity. Set up transaction notifications to receive alerts for every transaction, allowing you to detect and report any unauthorized activity promptly.

Who Benefits from Using Revolut?

Revolut is designed to cater to a wide range of users with different financial needs. Here are some groups that particularly benefit from using Revolut:

Frequent Travelers

- Multi-Currency Accounts: Hold and exchange multiple currencies at interbank rates, saving money on foreign transaction fees.

- Global ATM Withdrawals: Withdraw cash from ATMs worldwide without excessive fees.

- Travel Insurance: Access travel insurance and other travel-related perks.

Expats and International Students

- Cross-Border Transfers: Send money internationally with low fees and competitive exchange rates.

- Local Currency Spending: Spend in local currencies without incurring additional charges.

- Virtual Cards: Use virtual cards for secure online purchases and subscriptions.

Digital Nomads and Remote Workers:

- Global Accessibility: Manage finances from anywhere in the world with the Revolut app.

- Flexible Spending: Pay in different currencies and manage expenses easily.

- Freelance Payments: Receive payments from clients globally without high fees.

Investors and Crypto Enthusiasts

- Stock Trading: Trade stocks from global markets with no commission fees.

- Cryptocurrency Trading: Buy, sell, and hold cryptocurrencies directly within the app.

- Real-Time Tracking: Monitor investment performance in real-time.

Budget-Conscious Users

- Budgeting Tools: Set budgets and track spending by category to manage finances better.

- Spending Analytics: Gain insights into spending habits and make informed financial decisions.

- Savings Vaults: Save money for specific goals with personalized savings vaults.

Small Business Owners and Freelancers

- Business Accounts: Access Revolut Business for multi-currency accounts, easy invoicing, and payment processing.

- Expense Management: Manage business expenses and employee spending with dedicated business cards.

- Low Transaction Fees: Benefit from lower fees on international transactions and currency exchanges.

Tech-Savvy Individuals

- Innovative Features: Enjoy advanced features like virtual cards, instant notifications, and automated savings.

- App Convenience: Manage all financial activities from a single, user-friendly app.

- Security Features: Benefit from cutting-edge security measures like biometric authentication and real-time transaction alerts.

TL;DR- What is Revolut?

In today’s competitive world, financial and business growth is paramount. The evolving fintech sector, driven by innovation, is transforming banking. Revolut exemplifies this by simplifying multi-currency transactions and enabling free international money transfers, reducing costs for global transactions. Embracing fintech apps like Revolut can empower and simplify our lives.

Revolut offers a versatile platform catering to modern users’ needs, including frequent travelers, international students, and digital nomads. Its features include multi-currency accounts, budget tracking, cryptocurrency trading, and seamless money transfers. By setting up an account and leveraging these tools, you can manage your finances more conveniently, cost-effectively, and securely.

Want to make your own Fintech App like Revolut?

Are you planning to develop your own app like Revolut? Get advice from our experienced team, who have built an award-winning app similar to mobile development services and scaled successful startups and businesses for over 20 years. Contact us today for a free quote on your app development project.

Hi Hiral,

Thank you for the article on the fintech and on Revolut in particular. We were looking for a way to launch our own Fintech bank, however, it seems everyone wanted to charge us an enormous amount of money and time. It sounds like Ncrytpted make have a script to help us get started faster and at a lower entry price.

We will take a look at it now and contact your advisors for help going forward!

Thanks…